Artificial Intelligence (AI) is no longer a futuristic buzzword — it’s transforming how we save, spend, and invest money every single day. From budgeting apps that track expenses automatically to AI-driven investment advisors, the financial landscape in India is evolving faster than ever.

Let’s explore how AI is changing personal finance in India and why it’s a game changer for your money management.

💡 What Is AI in Personal Finance?

AI (Artificial Intelligence) uses machine learning, data analytics, and automation to help people make smarter financial decisions.

It studies your spending patterns, predicts your future expenses, and offers customized advice.

🧠 In Simple Terms:

AI is like your 24/7 smart financial assistant — analyzing data, reducing human error, and guiding you toward better money management.

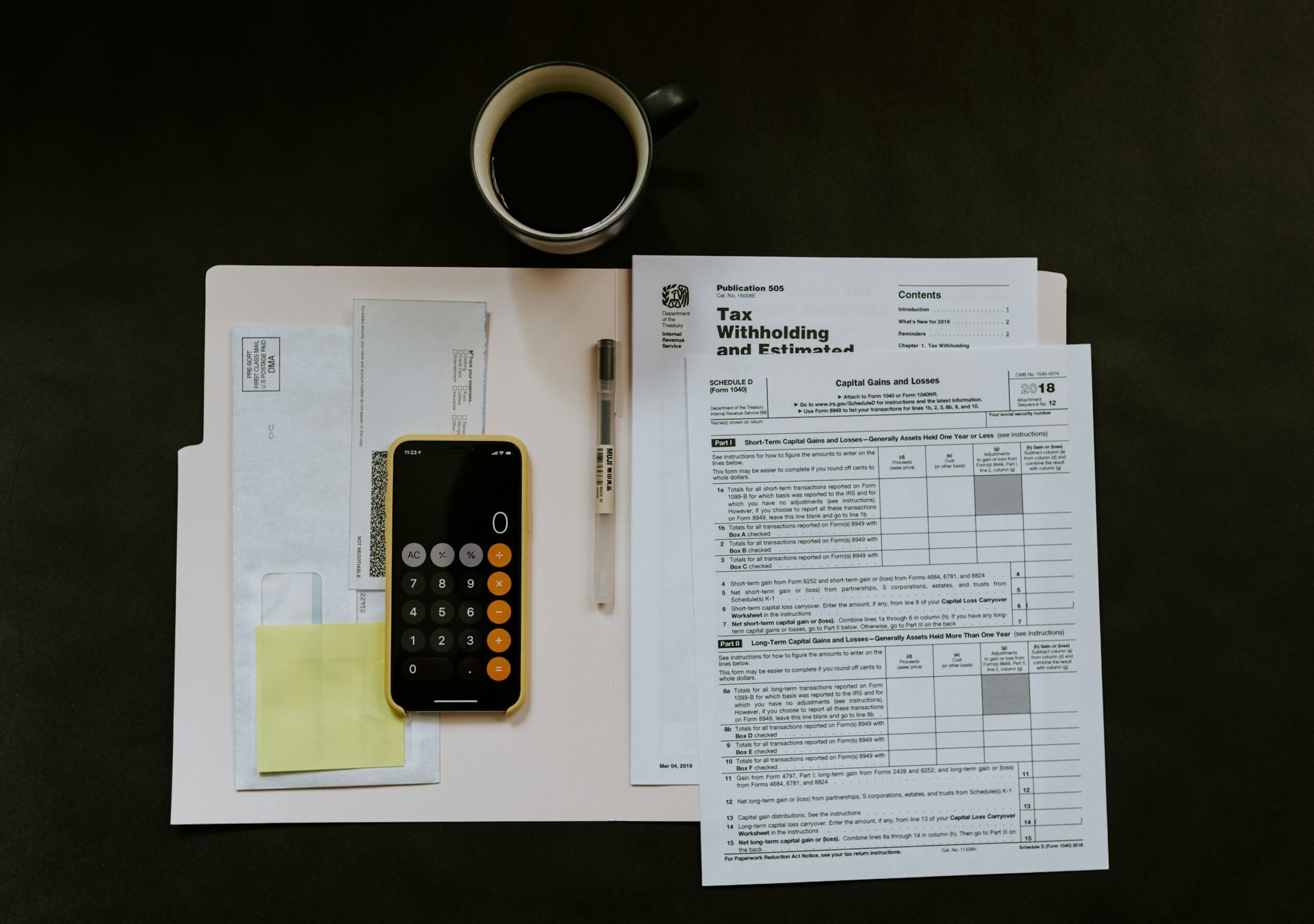

📱 1. Smart Expense Tracking and Budgeting

Gone are the days of manual expense entries. AI-powered finance apps now track and categorize your spending automatically.

✅ Example:

Apps like Walnut, Money Manager, and ET Money use AI to:

- Identify recurring payments

- Categorize expenses (food, travel, shopping)

- Provide weekly or monthly spending summaries

💡 Benefit:

You gain complete control over where your money goes — without doing extra work.

💰 2. AI-Powered Investment Platforms

Investing used to require professional help. But today, Robo-advisors powered by AI can manage your portfolio efficiently.

🔍 Examples:

Platforms like Groww, Kuvera, and Scripbox use AI to:

- Recommend personalized SIPs and mutual funds

- Adjust your portfolio based on market trends

- Reduce risk using predictive analysis

💡 Benefit:

Even first-time investors can make data-backed investment decisions with minimal effort.

🏦 3. AI in Digital Banking

Banks across India are adopting AI to enhance user experience and reduce fraud.

From chatbots to credit scoring, AI is making banking more efficient.

🏦 Example:

- HDFC Bank EVA – AI chatbot for instant customer support

- ICICI iPal – Automated financial assistant

- SBI YONO – Personalized financial recommendations

💡 Benefit:

24/7 support, faster transactions, and smarter insights — all powered by AI.

Also Read : Best Free AI Tools 2025 – Enhance Your Productivity with AI

🔐 4. AI for Fraud Detection and Security

Cybersecurity is critical in the age of digital payments.

AI helps banks and fintechs detect suspicious transactions in real time using behavioral patterns.

🔍 Example:

If your account suddenly sends a large transaction at midnight, AI algorithms instantly flag it for verification.

💡 Benefit:

Enhanced protection from online scams, phishing, and fraudulent activities.

💳 5. AI in Credit Scoring and Loan Approval

Traditional credit scoring relies heavily on CIBIL data.

AI-based credit models, however, evaluate alternative data like:

- Bill payments

- Mobile recharges

- Online shopping history

🧾 Example:

Fintech companies like KreditBee, PaySense, and CASHe use AI to approve loans faster.

💡 Benefit:

People with limited credit history can still access financial products using AI-driven risk analysis.

🧠 6. Personalized Financial Planning

AI learns your financial goals and spending habits to create a customized financial roadmap.

Example:

If you’re saving for a vacation, AI will:

- Track your spending

- Recommend saving amounts

- Send alerts when you overspend

💡 Benefit:

You get real-time guidance on saving and investment decisions.

🌍 7. AI and the Future of Indian Fintech

India’s fintech market is expected to reach $150 billion by 2025, and AI will play a central role in this growth.

With initiatives like Digital India, UPI 2.0, and AI-backed banking, the country is moving toward a more intelligent financial system.

Key Areas of Growth:

- AI chatbots for financial education

- Voice-based payments using NLP

- Predictive savings and auto-investments

🚀 How You Can Benefit from AI in Finance

Here’s how everyday users can take advantage of AI tools:

| Goal | AI Tool | Example |

|---|---|---|

| Budgeting | Expense Trackers | Money Manager, Walnut |

| Investing | Robo-Advisors | Groww, Scripbox |

| Security | Fraud Detection | Banks’ AI alerts |

| Planning | AI Assistants | ET Money, YONO |

⚙️ The Human Touch Still Matters

While AI is powerful, human judgment remains vital.

AI can assist, but you must verify and make final decisions — especially in high-risk investments.

💬 Pro Tip: Use AI as your helper, not your replacement. Combine data-driven insights with human experience for best results.

🧾 Conclusion

AI is revolutionizing personal finance in India by making it smarter, safer, and more personalized.

From automated budgeting to real-time fraud protection, AI ensures you manage money efficiently and confidently.

The future of finance is AI-powered, and it’s already here — in your pocket.

One thought on “🤖 How AI is Changing the Future of Personal Finance in India”